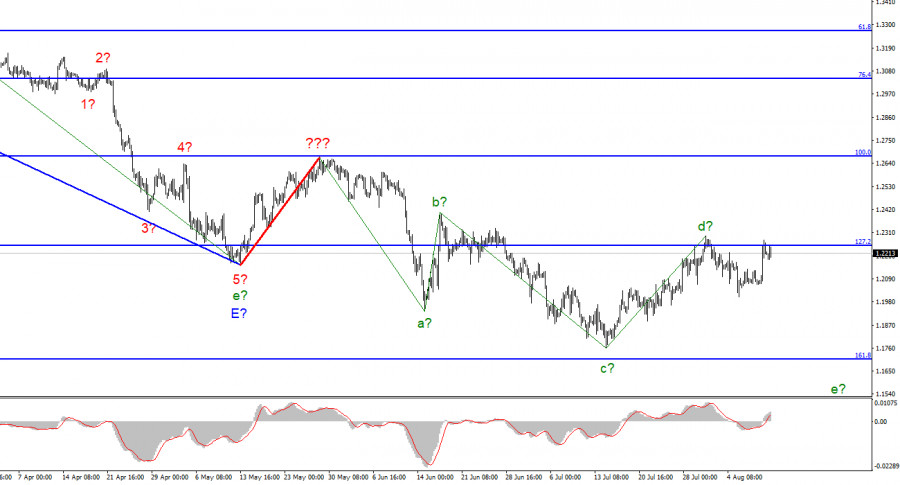

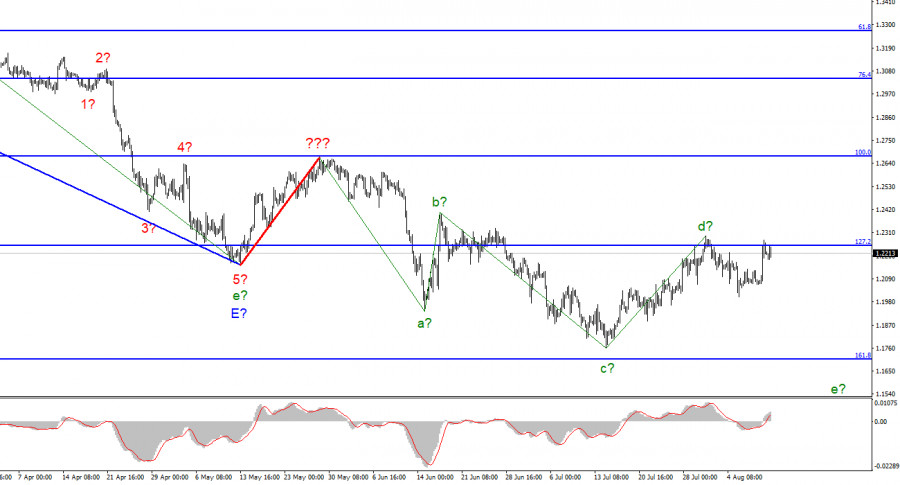

For the pound/dollar instrument, the wave marking looks quite complicated at the moment, but it does not require any clarifications yet. The upward wave, which was built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, it can now be concluded that the downward section of the trend takes a longer and more complex form. I am not a big supporter of constantly complicating the wave marking when dealing with a greatly lengthening trend area. It would be much more appropriate to identify rare corrective waves, after which new clear structures would be built. At this time, we have completed waves a, b, c and d, so we can assume that the instrument has moved on to constructing wave e. If this assumption is correct, then the decline in quotes should resume today or tomorrow. The wave markings of the euro and the pound differ slightly in that for the euro, the downward section of the trend has an impulse form (for now), but the ascending and descending waves alternate almost identically, and at this time, both instruments presumably completed the construction of their fourth waves at the same time. However, there are other, more significant, differences. Yesterday's US inflation report had a very bad effect on both wave markings.

The pound has risen, but Friday's statistics may lower it from the sky

The exchange rate of the pound/dollar instrument increased by only 10 basis points during August 11. During the day, the amplitude was about 30 points, much less than the day before. However, today there was no news background either. On Friday, the market will have to monitor all incoming data very closely, as there will be many of them, and their values may contradict each other. Five or six reports will be released tomorrow in the UK, which should be paid attention to. The key is the report on GDP in the second quarter. But besides that, there will be a report on industrial production in June, a report on the trade balance in June, and several reports on GDP for different periods and variations. The market will receive so much information in the morning that the instrument can show an enviable range of movements.

In the afternoon, the news background will be easier. I advise you to pay attention to the consumer sentiment index from the University of Michigan, which has dropped to the lowest levels in its history of monitoring this indicator in recent months. All other reports will be too secondary. Nevertheless, what is listed above may be enough to change the wave pattern. Of course, British data will be more important. We need weak statistics so that the demand for the US currency grows, not decreases. Judging by expectations, there should be no problems with this, since now, after Andrew Bailey's words about the recession in the British economy, only the lazy do not expect a reduction in GDP. There are real chances of a decline in the instrument tomorrow. But a successful attempt to break through the 1.2250 mark, which corresponds to 127.2% Fibonacci, will most likely mean that the wave marking will again suffer certain changes.

General conclusions

The wave pattern of the pound/dollar instrument suggests a resumption of the decline. I now advise selling the instrument with targets near the estimated mark of 1.1708, which equates to 161.8% Fibonacci, for each MACD signal "down." But a successful attempt to break through the 1.2250 mark will indicate the cancellation of the scenario with the instrument sales.

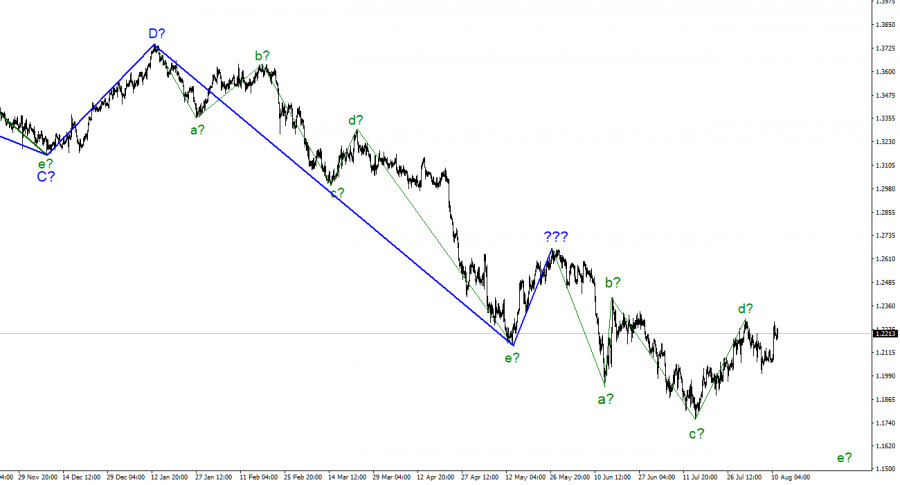

At the higher wave scale, the picture is very similar to the Euro/Dollar instrument. The same ascending wave does not fit the current wave pattern, the same three waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.